You Get What YOU (are forced to) PAY FOR

Above the Law - Uncle Sam's Curse

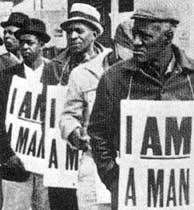

The Unemployed - They Won't Let Me

Sharon Jones & the Dap Kings - This Land is Your Land

Brother Ali - Uncle Sam Goddamn

Fred Wesley & the JBs - I'm Payin' Taxes, What Am I Buyin'?

With tax day fast approaching, we've ALL been making sure to dot our i's and cross our t's. We've gotta keep the IRS from knockin' on our doors. As you write that check, have you ever wondered what they actually DID with your money (as you simultaneously wonder why your tax check seems to get bigger every year?!?!)?

Using the United States 2008 fiscal year budget, the National Priorities Project, a nonprofit, nonpartisan education and advocacy group decided to actually sit down and crunch some numbers.

27 cents out of every one of our tax dollars goes towards defense and the current military operations in Iraq. If you include the interest owed from military debt, you can add another ten cents.

Priorities?!!?! Not so much. Education gets a nickel on the dollar. Affordable housing? 2 shiny pennies. I don't even want to know what is included in the "other" column.

Do you want to actually SEE where your money will go? Before you send your check to UNCLE SAM, visit the National Priorities Project Interactive Income Tax Chart. Enter the amount of federal income tax you will pay and see how the government spent the money. Once you've picked up your jaw from off the floor, don't forget to put that check in an envelope, put a stamp on it, and send it to Uncle Sam.

Do you feel your tax dollars could be better spent? Do you think that our government's priorities are EFFED UP? Visit the Federal Budget Trade-Offs site to see how YOUR government COULD have spent their money. If you live in NEW YORK state, here's how our money stacked:

- NY state residents' contribution to the 2007 fiscal year ballistic missile defense budget could have provided 180,535 people with health care coverage.

- NY state residents' contribution to the 2007 fiscal year Iraq War budget could have provided the state with 70,169 affordable housing units.

- NY state residents' contribution to the 2007 fiscal year nuclear weapons budget could have provided the state with 173,586 Head Start locations.

- 5.9 billion dollars in tax cuts were afforded to the wealthiest 1% of NY state. This additional income could have provided 971,836 students with college scholarships.

5 Comments:

Once again, so enlightening, so on point.

You need to go pro with this blog ish.

Posts like this aren't good for me to read at work on days I was listening to Rage Against the Machine....I might burn something.

Then again I listen and I just keep hoping.

"Hungry people don't stay hungry for long. They get hope from fire and smoke as the weak grow strong"

@anon - thanks for the kind words. they keep me on my grind.

@amadeo - yeah. when i saw the report i nearly flipped. damn, if i listened to rage at work i'd definitely break something or hit someone.

PEACE

I just hit someone.

How can you advocate something like "writing that check" on on or before 4.15?

The 16th amendment has nothing to do with citizens paying taxes. All resultant ruling by the Supreme Court have upheld this truth. Income, as it is described in said amendment speaks to exchanges of good in which profits are derived, which is to say the 16th only applies to CORPORATIONS.

Though IRS fools will go on television and tell you their prosecution rate is 100%, this is hardly true. And the only thing today where prosecution of "tax evaders" (an non-reality if i've ever heard one) approaches 90% is in the lower courts, where judges now have taken the tack of uttering the abominable, "You cannot mention the Supreme Court and the Constitution in my court. Nor can you mention 'the law' as it pertains to taxes in my court."

That sentence has become a pat judicial uttering in federal district courts so that judges can skirt the fact that there is no law stating that U.S, citizens must pay federal taxes. In fact, most states' laws state that their taxes must be paid "only if you VOLUNTARILY pay federal income taxes."

This is a wakeup call peeps....

Post a Comment

<< Home